INTERNATIONAL COMMERCIAL TERMS (INCOTERMS)

When you’re shipping goods internationally, there are a few terms that you should recognize and understand. INCOTERMS are used in 31 different languages, and you can find them in sales contracts as well as letters of credit.

What are INCOTERMS?

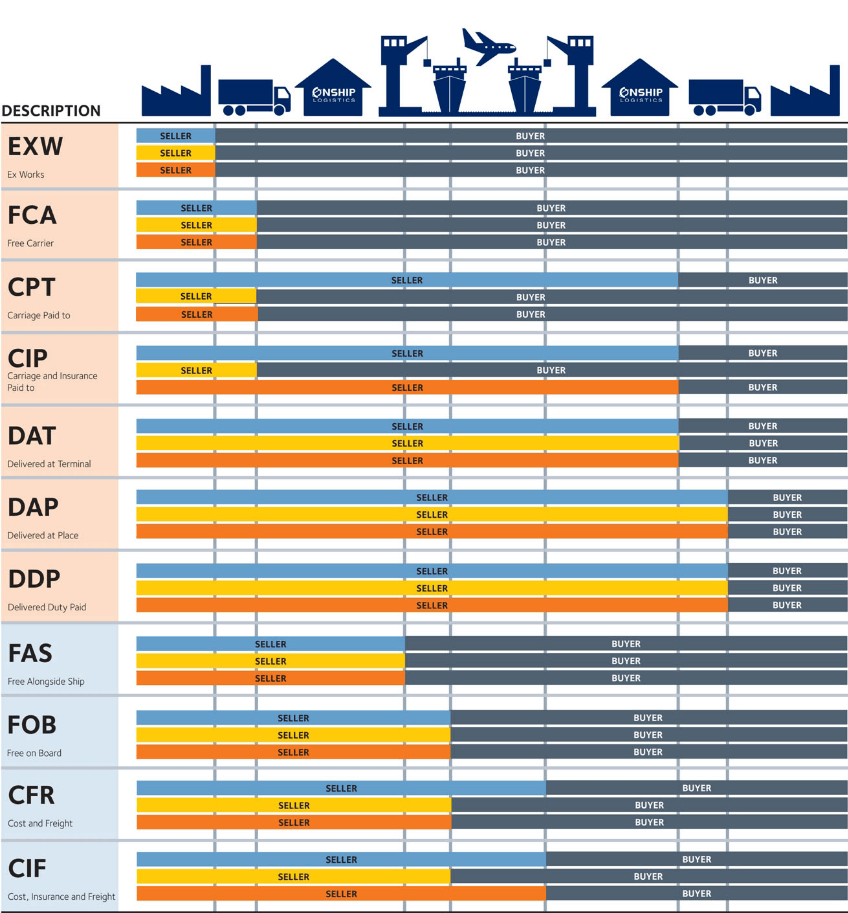

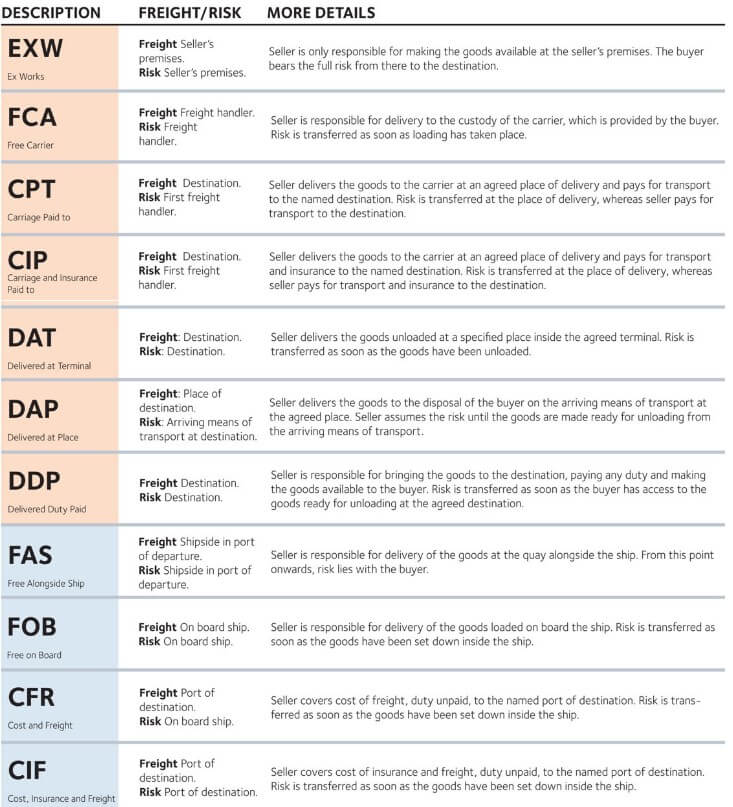

INCOTERMS are property of the International Chamber of Commerce and can be broken down into 4 categories: E, F, C, and D terms. Each INCOTERM is a code represented by three letters and a location. E terms refer to situations where the buyer can access the goods at the seller’s premises, while F terms involve the seller delivering the goods to a carrier. With C terms, the exporter arranges the shipping of the goods but isn’t responsible for damage. When the seller is responsible for both cost and risk, D terms are used.

How are INCOTERMS used?

Language is important when you’re making a deal, but things can get confusing when each party speaks a different one. INCOTERMS keep everyone on the same page and describe the nature of the transaction. Different INCOTERMS would be employed for different types of transport. Some work for any kind of transportation, while others are only applicable to water transportation.

Why Incoterms are important?

It’s crucial that you are as clear as possible when working on a deal that involves international shipping, INCOTERMS lay out the costs and risks in each transaction and define what each party is responsible for. These terms help keep both sides on the same page, and they help to ensure that the goods are delivered safely and efficiently.

Basics of INCOTERMS:

- Owned by International Chamber of Commerce

- Standard Trade Definitions, available in 31 languages

- Used by customs and banks

- Found in sales contracts and letter of credit

- Current edition is INCO 2020

INCOTERMS are a set of three-letter standard trade terms most commonly used in international contracts for the sale of goods. First published in 1936, INCOTERMS provide internationally accepted definitions and rules of interpretation for most common commercial terms.

What is the importance of INCOTERMS when quoting?

Provides clarity about the underlying commercial transaction. INCOTERMS inform the sales contract by defining the respective obligations, costs and risks involved in the delivery of goods from the Seller to the Buyer.

INCOTERMS rules are grouped into 4 categories:

- The “E” term: (EXW) – The only term where the seller/ exporter makes the good available at his own premises to the buyer/ importer.

- The “F” terms: (FCA, FAS and FOB) – Terms where the seller/ exporter is responsible to deliver the goods to a carrier named by the buyer.

- The “C” terms: (CFR, CIF, CPT and CIP) – Terms where the seller/ exporter/ manufacturer is responsible for contracting and paying for carriage of the goods, but not responsible for additional costs or risk of loss or damage to the goods once they have been shipped.

- The “D” terms: (DAF, DES, DEQ, DDU and DDP) – Terms where the seller/exporter/manufacturer is responsible for all costs and risks associated with bringing the goods to the named place of destination.

INCOTERMS rules example

Three letters followed by location: i.e. FOB Shanghai

Not all INCOTERMS are appropriate for all modes of transport. Some terms were designed with sea vessels in mind while others were designed to be applicable to all modes.

The following table sets out which terms are appropriate for each mode of transport.

OCEAN FREIGHT TERMS

| ABI | Automated Broker Interface |

| AES | Automated Export System: The US Customs and Border Protection (CBP) system for electronic filing of Shipper’s Export Declaration (SED) and ocean manifest information directly to CBP. |

| AMS | Automated Manifest System: A part’s of Customs’ Automated Commercial System (ACS), controls imported merchandise from the time a carrier’s cargo manifest is electronically transmitted to Customs. |

| BAF | Bunker Adjustment Factor: An adjustment in shipping charges to offset price fluctuations in the cost of bunker fuel |

| BL | Bill of Lading |

| Break | The movement by ocean of packaged goods that are not containerized |

| BSC | Bunker Surcharge |

| BULK | Homogenous cargo that is stowed loose in the hold of a ship and is not enclosed in a shipping container or box, bale, bag or cast |

| CAF | Currency Adjustment Factor |

| CFS | Container Freight Station |

| Courier | Expedited, personalized package and document handling |

| CSC | Container Service Charge |

| CY/CY | Container Yard to Container Yard. |

| DTD | Door to Door |

| DTP | Door to Port |

| EDI | Electronic Data Interchange |

| ETA | Estimated time of Arrival |

| ETD | Estimated time of Departure |

| EX DEC | Shipper’s Export Declaration |

| FAF | Fuel Adjustment Factor |

| FAK | Fit All Kinds |

| FCL | Full Container Load |

| FSC | Fuel surcharge |

| GRI | General Rate Increase |

| GRR | General Rate Restoration |

| HBL | House Bill of Lading |

| IFC | Importer Security Filing (10+2 rule) and additional Carrier Requirements Information |

| LCL | Less than Container Load |

| NVOCC | Non-Vessel Operating Common Carrier |

| OTI | Ocean Transportation Intermediary |

| PPS | Pier Pass Surcharge |

| PSS/PSA | Peak Season surcharge / Peak Season Adjustment |

| PTP | Port to Port |

| TEU | Twenty-foot equivalent unit. Used to measure a vessel’s capacity. |

| THC | Terminal Handling Charges |

| TRC | Terminal Receiving Charges |

Other Charges: Clean truck fee, Handling Charges, Security Fee, Courier Fee.

1O + 2 REQUIREMENTS

The rule will mandate that importers of ocean cargo, or their authorized agents, supply U.S. Customs and Border Protection (CBP) with 10 additional data elements and ocean carriers to supply an additional 2 data sets. This information is to be required 24 hours prior to vessel loading in the foreign port and must be filed at this time by the Automated Broker Interface (ABI).

The ten data elements to be required are:

- Manufacturer (or supplier) name and address

- Seller (or owner) name and address

- Buyer (or owner) name and address

- Ship-to name and address

- Container stuffing location

- Consolidator (stuffer) name and address

- Importer of record number (or foreign trade applicant identification number)

- Consignee number(s)

- Country of origin

- Commodity HTSUS number (to the 6th digit)

The carrier is responsible for providing to CBP vessel stow plans and container status messages through the Automated Manifest System (AMS).

For more detailed information about the Importer Security Filing, please visit the CBP website here.

INCOTERMS 2020 Timeline

1. What’s new about INCOTERMS 2020

The most current revision of the terms, Incoterms 2020, went into effect on Jan. 1, 2020, and consists of 11 Incoterms. Incoterms 2020 rules don’t deal with the transfer of ownership of the goods, breach of contract, or product liability; all of these issues need to be considered in the contract of sale. Also, Incoterms 2020 rules can’t override any local country laws. If you want to know all the details and changes brought by Incoterms 2020, please check out this article: What’s new on Incoterms 2020.

2. What’s new in INCOTERMS 2021 and why it’s important

As you already know, Incoterms rules are updated every 10 years. If you want to take a look at the list of the most frequent Incoterms used in 2021, we have an article highlighting them. You will find a separate list of terms when it comes to the sea and inland waterway transport rules.

3. Differences between INCOTERMS 2020 and 2022

Still, have doubts about Incoterms? Check out the most frequently asked questions on this topic and 2022 important Incoterms highlights.

Any doubt about Incoterms?

Do you have questions about INCOTERMS and the terminology associated with it? At ILS we are fortunate enough to work with some of the most qualified professionals in the industry.

Feel free to send us a message here or give us a call at 1-800-ILS-9712